The central idea of Modern Monetary Theory (MMT), as I understand it, is that, rather than worrying about budget balances, governments and monetary authority should set taxation levels, for a given level of public expenditure, so that the amount of money issued is consistent with low and stable inflation. In this context, the value of the net increase in money issue is referred to as seigniorage. To the extent that seigniorage is consistent with stable inflation, it is achieved by mobilising previously unemployed resources.

A crucial question is: what is the scope for seigniorage? In particular (expressing things in MMT terms), is the scope for seigniorage sufficient to permit the introduction of ambitious programs like a Green New Deal without the need for higher taxes to prevent inflation.

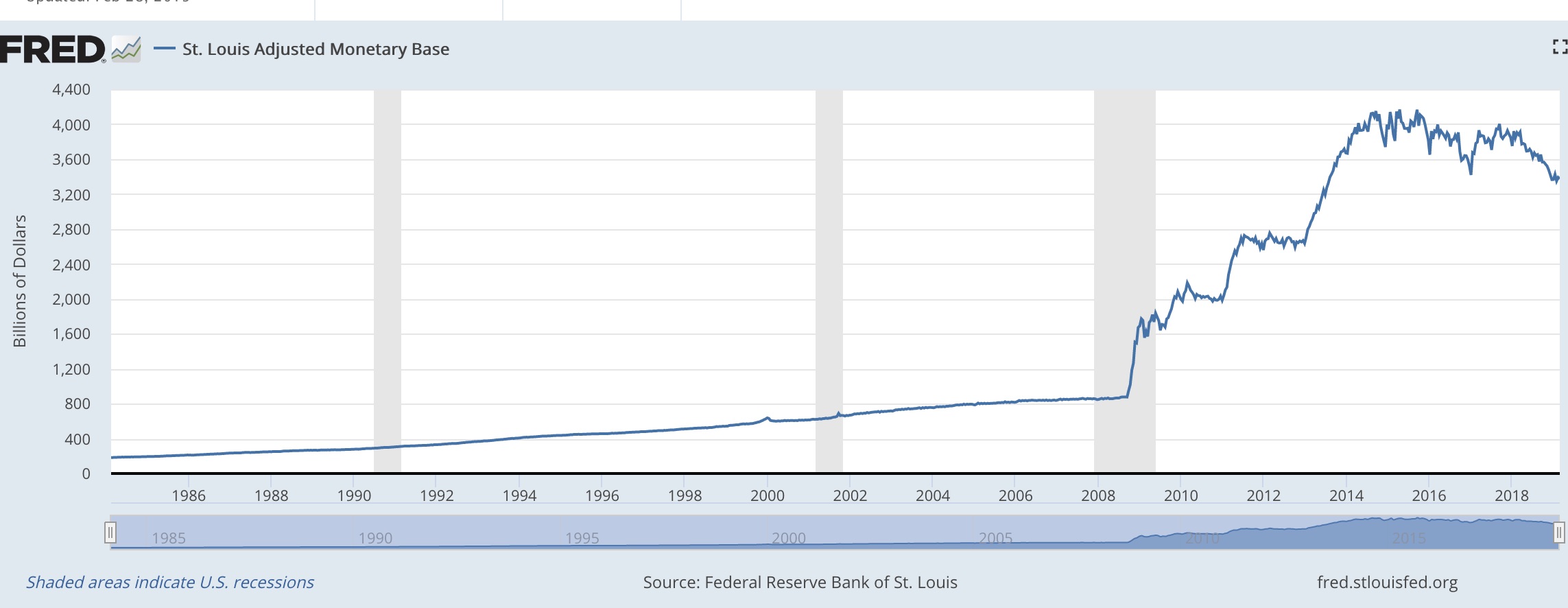

The recent episode of Quantitative Expansion in the US provides some evidence here. Contrary to the dire predictions of some critics, QE did not lead to runaway inflation. This is consistent with the view, shared by MMT advocates and mainstream Keynesians, that, in the context of a liquidity trap and zero interest rates, there is substantial scope for monetary expansion.

How much is “substantial”?

According to the St Louis Fed,

the monetary base grew from around $800 billion to just over $4

trillion between 2008 and 2016. That’s an increase of $3.2 trillion,

which is a lot of money. Expressed in terms of GDP, though, it doesn’t

seem quite as large. Over eight years, $3.2 trillion is $400 billion a

year or around 2 per cent of US GDP ($20 trillion).