by Daniel on September 17, 2021

You wouldn’t have thought that this was a difficult or controversial question. But actually it’s both. It’s controversial because it’s more or less the central battleground for Modern Monetary Theory, and therefore an absolute magnet for bad tempered online debate. And it’s difficult for the same reason that a lot of things are difficult: the question looks like a reasonable one that should admit of a short answer, but that’s because all of the complexity and ambiguity is packed up into the fact that words are used in an ordinary language sense but the statements made with them need to be precise.

There are two possible courses of action in a situation like this. The first is to say either “very few people in this debate are confused about the actual facts, so this is really a dispute about semantics and since I am not in an iron lung, I have better things to do” or, depending on your circumstances, “despite being in this iron lung, I just got a new adult colouring book”, and then get on with your day. This is quite attractive, and I wouldn’t blame anyone for taking it.

But it’s not wholly satisfactory, because although few people actively involved in this controversy are confused, there are a lot of people in general who are confused about the relationship between taxes and spending and who think “taxes fund spending” is an uncontroversial and obviously true statement. And the process of un-confusing them is made a lot more difficult by the unclear semantics. That’s the point (when there is one) of semantic debates : if you have the semantics squared away then when people say dumb or contradictory things then they sound dumb and contradictory, but while the language is confused, they might sound profound or practical.

And so we come to the second course of action, which is “ENDLESS SQUABBLING”. Hurray!

[click to continue…]

by Daniel on January 11, 2019

Earlier in the week, a thinktank called “Onward UK” got some press for a report condemning the proliferation of “Mickey Mouse Degrees” in British universities. You might think (and indeed say, as I did) that a bucket shop policy institute consisting of a recently resigned special advisor and a “Senior Research Fellow” with a lobbyist day job has a bit of brass neck calling anyone else “Mickey Mouse”, and that’s why I’m not linking to the report (although I did finally crack and read it; it’s not terrible quality stuff, but as an example of the genre of policy entrepreneurship it’s an American trend that I don’t want to see embedding in British public life). Instead of getting into an empirical debate, I want to address what I see as a more interesting question; the whole way we think about our creative industries is fundamentally misconceived, because of a sort of methodological individualism that stops us seeing the system as a system.

[click to continue…]

by Daniel on October 5, 2018

I don’t know much about “grievance studies”, but I do know quite a lot about fraud, having written a book on the subject and spent two years researching it (and now three months more researching some additional bits for the US edition, out in 2019). So just a further observation after Henry’s post on the subject – one thing that I think is underappreciated in a variety of contexts is that the susceptibility of a system to intentional deceit is not by any means a good indicator of the underlying health of that system. In fact, I would even go so far as to say that the equilibrium level of fraud is determined entirely separately from the equilibrium level of quality and output, and that therefore the ease with which X can be faked is irrelevant to your assessment of whether there are severe problems with X.

[click to continue…]

by Daniel on August 11, 2017

I have now read that “google manifesto”. I read it more out of a desire to forestall people saying “but have you ACTUALLY READ IT?” than out of any expectation that it would contain new or unfamiliar information, and indeed it was your fairly standard evo-psych “just asking questions”, genus differences-in-tails-of-distributions. It’s a mulberry bush that was already pretty well circumnavigated when Larry Summers was still President of Harvard. But what really struck me was that I have changed in my old age; I used to be depressed at the generally very poor level of statistical education, now I’m depressed at the extent to which people with an excellent education in statistics still don’t really understand anything about the subject. I’m beginning to think that mathematical training in many cases is actually damaging; simple and robust metrics, usually drawn from the early days of industrial quality control, are what people need to understand. Let’s talk about distributions of programming ability.

[click to continue…]

Readers may have noticed that the British Labour Party has gone kind of mad this week, and decided to make the question of whether Adolf Hitler was a Zionist a key issue in the local election campaign. I’ve written in the past on Crooked Timber about why I think it is that the general question of Israel and Palestine is so unfailingly nasty and full of toxic bullshit. But I think it’s also worth looking at why this is specifically a problem for left wing politics in the UK. Below the fold, a loooong attempt at a structural explanation of a persistent phenomenon.

[click to continue…]

by Daniel on April 21, 2016

by Daniel on April 8, 2016

When some things have holes in them, it’s a sign of decay, like a beam with termites. But some things are meant to have holes, like Swiss cheese. I agree with John’s view on “holes and gaps”, but as always, I tend to assign agency to the political system more than to the financial sector. Nearly all of those holes were intended to be there, and it was intended that the financial system used them. The process whereby the behaviour involved is redefined from acceptable deviancy to unacceptable is very interesting, like the last chapters of a John le Carre novel by way of Foucault. A few thoughts below, ranging in geopolitical scope from “vast” to “cosmic”, in a comment which grew into an alternative monetary history of the second half of the twentieth century.

[click to continue…]

by Daniel on March 23, 2016

I have a new piece up on The Long And Short, suggesting that the “Evidence Based Policy Making” movement ought to be really very worried about the reproducibility crisis in the psychological and social sciences. In summary, the issue is that most of the problems that the sciences are dealing with are highly likely to be there in policy areas too, meaning that the evidence base for education reform, development economics, welfare and many other policy areas is equally likely to be packed with fragile and non-replicable results. I do suggest a solution for this problem (or rather, I endorse Andrew Gelman’s solution), but point out that it is likely to be expensive and time-consuming and to mean that evidence-based approaches are going to be a lot slower and deliver a lot less in the way of whizzy new policy ideas than people might have hoped.

[click to continue…]

by Daniel on February 24, 2016

So, this morning I had a brief Twitter conversation with Simon Jack, the economics editor of the Today programme, about a metaphor he used to introduce an interview on the subject of the British Pound’s sharp devaluation as the EU exit referendum was launched. The line which annoyed me at seven o’clock this morning was:

“I think of the exchange rate as something like a national share price, and ours has been falling”

See below for why, although I understand the point he was trying to make, I think this is not a good way to think of exchange rates…

[click to continue…]

by Daniel on December 2, 2015

Below, I review, in usual rather semi-detached style, the book by friend-of-the-blog Doug Henwood on Hillary Clinton’s candidature for President. A capsule summary might be: he’s against it. I’ve posted the cover image below because it’s so fantastic.

The meaning of the image is discussed in the book

by Daniel on August 12, 2015

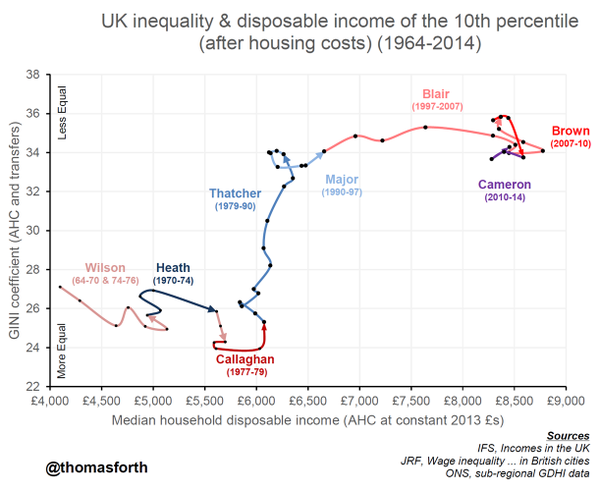

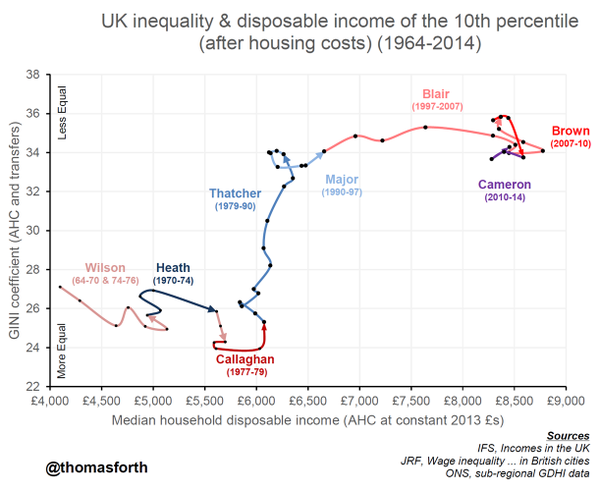

A really interesting chart, via Tom Forth on that Twitter. It plots inequality in the UK against the income of the poorest 10%, as a time series.

This is a perfect application of interocular trauma econometrics – it hits you right between the eyes. It’s all up-and-down or left-and-right. The sort of thing that generates the difficult cases for liberal political philosophy – increases in inequality which nevertheless benefited the worst-off, which would have showed up as a southwest-to-northeast upward slope – never happened.

by Daniel on July 4, 2015

After Chris and John’s posts, a lot of which I agree with, I thought it made sense to look at the third member in the three-cornered disaster in Euroland …

When you look at this series, two things strike the eye. One, good God what a long and deep recession. And two, it was coming to an end. Even the worst policy mistakes don’t last forever and a combination of time, human resilience and the Pigou Effect will usually prevail. Greece had two quarters of consecutive growth at the beginning of 2014. Unemployment also began to fall. They were issuing bonds on the open market and had some hopes of completing the second bailout program with a degree of success.

Then, Syriza happened.

[click to continue…]

by Daniel on May 26, 2015

This is a post I’ve been planning to write for a while, with various other CT members alternately encouraging me to do so, and sternly reminding me that the consequences will be entirely on my own head ;-). It’s based on a point I’ve been making over the last few years to all sorts of friends when they’ve been trying to bait me on the subject of LIBOR, forex and the various scandals of the financial profession.

The point is quite simple. Bankers have had their day under scrutiny. But so have Members of Parliament (expenses scandal). So have journalists (phone hacking). So has the Church (paedophilia cover-ups). So has the BBC (ditto). This isn’t a specific issue about financial sector corruption. It’s a general trend, one of gradual social re-assessment of whether the fiddles and skeletons of the past are going to be tolerated in the future. It’s not that these sectors are especially dirty and the rest are especially clean – it’s just that politics, finance, religion, journalism and broadcasting have, so far, had their day under the microscope. One day, it’s going to point somewhere else. Particularly (because a lot of my friends are academics), one day it’s going to point at the universities. How confident are we that when it does, that they’ll be found pure?

At this point I tend to get either nervous laughter or outrage. Comments boxes don’t do nervous laughter very well, so readers of a ragey disposition might as well skip the details…

[click to continue…]

by Daniel on May 16, 2015

Almost as an illustration of the sort of thing John’s looking at in terms of misplaced opportunity costs, I have a piece up at medium.com on forthcoming changes to the UK benefit cap system, and how they could have fairly serious consequences for housing benefit tenants. I probably don’t emphasise it enough in the piece, but these knock on effects destroy the cost economics of the policy – once tenants are evicted because they can’t pay the rent, they become emergency cases and have to be accomodated by the council in short-term accomodation, which is one of the most wasteful and expensive things you can do in housing policy. As I said in discussion of the piece, if you don’t like subsidising these guys as buy-to-let landlords, you’re unlikely to love them when they come back as bed-and-breakfast proprietors, at twice the price.

by Daniel on April 24, 2015

Hello once more! This episode of my travelogue takes in Tahiti/Moorea and Easter Island. I’m writing this from Chile, where the next episode might be quite dramatic …

[click to continue…]