For a generation (fifteen years) or more I’ve been writing and rewriting the same piece about the silliness of the “generation game”, the idea that one’s year of birth matters more than class, gender or race in determining life outcomes and attitudes. But this is a zombie idea that can never be killed.

Stephen Rattner in the New York Times is the latest example, with a piece showing that US Millennials (those born after 1980) are doing much worse than previous generations at the same age, despite higher levels of education. Rattner notes the role of the recession, now nearly a decade old, but then jumps to the conclusion that it is the Baby Boomers, as a group, who are to blame. His only evidence for this is the long-discredited claim of a looming crisis in Social Security.

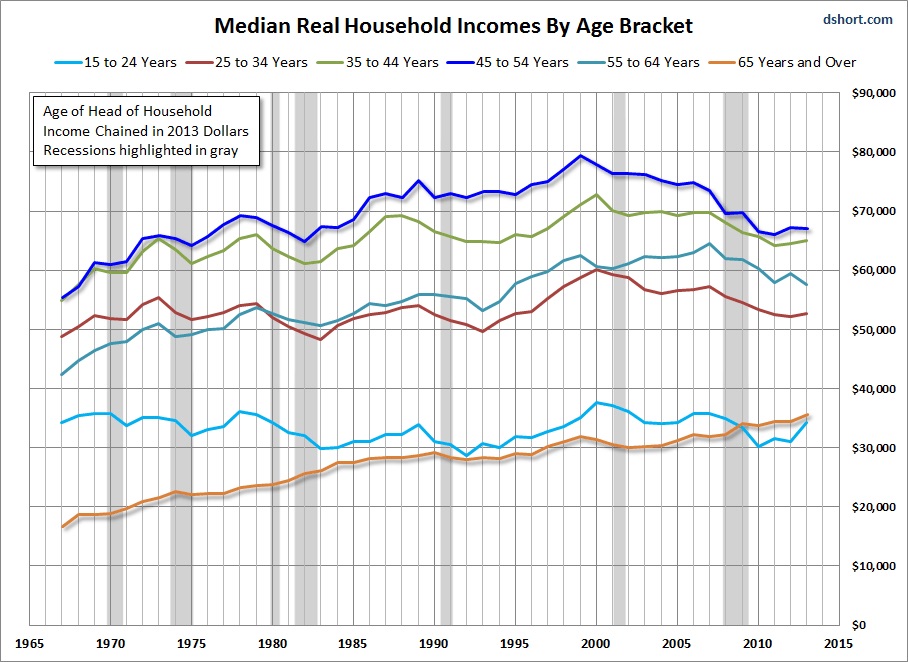

Rattner doesn’t present any evidence about the recent experience of non-Millennials, but his piece leaves the impression that the experience of doing worse than older cohorts at the same age is uniquely Millennial. So I thought I’d do his work for him, and dug out this graph prepared by Doug Short  As can be seen, the group suffering the biggest loss, relative to older cohorts at the same age, are those households with heads aged 45-54 in 2013, a mix of late Boomers (for aficianados, this group is called Generation Jones) and early X-ers. But the main point is that median household income is falling for all groups except the 65+ cohort (mostly called Silents in the generation game). Part of this is due to declining household size, but (IIRC) household size has stabilized recently as forming a new household has become less affordable.

As can be seen, the group suffering the biggest loss, relative to older cohorts at the same age, are those households with heads aged 45-54 in 2013, a mix of late Boomers (for aficianados, this group is called Generation Jones) and early X-ers. But the main point is that median household income is falling for all groups except the 65+ cohort (mostly called Silents in the generation game). Part of this is due to declining household size, but (IIRC) household size has stabilized recently as forming a new household has become less affordable.

Rattner doesn’t mention, even once, the obvious and well-known explanation for the fact that median income is falling while mean income rises. This can only occur if the distribution of income is becoming more skewed, with the top tail (the 1 per cent) benefiting at the expense of everyone else.

If Boomers as a group have done no better than anyone else, can Rattner at least claim that it was Boomer mismanagement that brought the economy to its present pass. Not really. Here’s Time Magazine’s list of 25 people who made big contributions to bringing about the Global Financial Crisis. The top three (Angelo Mozilo, Alan Greenspan and Phil Gramm) are all Silents, as is the emblematic Ponzi figure Bernie Madoff, and, a striking omission, Robert Rubin. And that’s without even considering the financial deregulation of the 1970s, which set the whole process in motion. Inevitably, given that they constitute a large share of the adult population, there are plenty of boomers among the bit players in the list. Equally, given the preference of Wall Street firms for young hotshots, much of the actual work of designing and selling bogus securities was done by X-ers in their 20s and 30s.

The point here is not that one generation is more or less to blame than another. As I said back in 2000, most of what passes for discussion about the merits or otherwise of particular generations is little more than a repetition of unchanging formulas about different age groups. The people who caused the crisis were mostly born before 1945 because they were of the right age to hold powerful positions in the financial sector in the 1990s. But it was their membership of the 1 per cent that is what matters here.

{ 83 comments }

Swami 08.05.15 at 10:25 pm

“Rattner doesn’t mention, even once, the obvious and well-known explanation for the fact that median income is falling while mean income rises. This can only occur if the distribution of income is becoming more skewed, with the top tail (the 1 per cent) benefiting at the expense of everyone else.”

Not exactly true. For arguments sake I will concede that it is quite likely the top income earners are earning so much that they can drive up the average while the median drops. So far so good. Beyond this though you are simply asserting that they benefit “at the expense of everyone else.” It could be that the two trends (downward median and upward superstar incomes) are two unrelated trends. It could be they are related trends (with common causes) but not a zero sum dimension. It could be that there is a zero sum dynamic. Finally it could be that the rising incomes of the top are actually helping the trend of the median person and that they would do even worse if the superstars weren’t raking in so much money.

My guess is that all these explanations are partially true in some cases.

In addition, I would suggest at a deeper and broader level all these twists on the statements are true in some ways for the relationship between the historically unprecedented recent increases in average incomes worldwide and median incomes in the US.

Sebastian H 08.05.15 at 10:35 pm

Swami, your argument is more likely to be true in any sector outside of finance. If computers manufacturers are doing well it may also be that software engineers do well in a non zero sum fashion (or even in a virtuous circle fashion). If finance is doing really well while the rest of the economy isn’t, that is almost certainly a problem of taking “at the expense of everyone else” because the purpose of finance is to facilitate the functioning real producers and service providers. The term of art needed for that kind of situation is “rent seeking” or “rent extraction”.

John Quiggin 08.05.15 at 10:42 pm

If you want to be pedantic, Swami, read it as “the top 1 per cent are gaining, while the average (median) household is losing”

Mike Furlan 08.05.15 at 11:06 pm

The question seems to be:

Is inequality a cause of falling median incomes?

Or, if not for the genius of our 0.0001% would we have sunk back into a new dark ages by now?

cassander 08.06.15 at 12:27 am

This census data doesn’t include benefits, and probably doesn’t include non-cash payments from the government, which makes the growth over time relatively meaningless.

medrawt 08.06.15 at 12:35 am

Sorry if I’m missing an obvious point, but do you also think tying year of birth (more or less) to life outcomes is a zombie idea within “generations”? i.e., I thought it was well established over several 20th century recessions that individuals who were entering the workforce during an economic downturn continued to do worse economically many years later vs. those who, by virtue of being a year or two older, had been able to establish themselves earlier.

John Quiggin 08.06.15 at 1:06 am

@6 I discuss this point in the linked article. What’s critical here is that business cycle timing doesn’t match demographically defined generations. Older Boomers entered a booming labor market, younger ones came in during the 70s.

medrawt 08.06.15 at 1:12 am

I certainly agree with that. I’ve never understood why it makes sense to lump me (professionally, economically, culturally), born in 1982, in with people born in 1970 … or my father, born in ’55, with those born in ’45.

oldster 08.06.15 at 2:46 am

I read it a few days ago in the times.

It seemed to me that the entire piece was the most blatant bait and switch.

Bait: I feel sorry for kids these days!

Switch: so we should destroy Social Security!

It was just another entry in the elites’ long-running struggle to destroy the social safety net. They change rationales every week–deficits, debts, moral hazard, work ethic, socialism, there’s always some reason why the safety net must be destroyed.

This week it was, “let’s pretend that we care about young people.” But that pretense was tissue-thin.

Barry 08.06.15 at 1:24 pm

“This week it was, “let’s pretend that we care about young people.†But that pretense was tissue-thin.”

A standard neoliberal/neocon line is to claim to care about some group of people, while trying to f*ck them over or flat-out kill them.

MPAVictoria 08.06.15 at 1:41 pm

Can we at least blame the people who voted for Reagan and Thatcher?

oldster 08.06.15 at 1:50 pm

“Upon graduating from Brown, Rattner was hired in Washington D.C. as a news clerk to legendary New York Times columnist James Reston…. he became close friends with future Times publisher Arthur Ochs Sulzberger, Jr., and dated Judith Miller.”

“At the end of 1982, Rattner left The New York Times and was recruited by Roger Altman to join the investment bank Lehman Brothers as an associate. After Lehman was sold to American Express in 1984, he followed his boss Eric Gleacher and several colleagues to Morgan Stanley, where he founded the firm’s communications group. In 1989, after Morgan Stanley filed for an initial public offering, he joined Lazard as a general partner and completed various deals for large media conglomerates such as Viacom and Comcast. Alongside Felix Rohatyn, Rattner became Lazard’s top rainmaker in the 1990s. Michel David-Weill named him the firm’s Deputy Chairman and Deputy Chief Executive in 1997.”

And so it goes. A long public record of caring deeply about young people.

Swami 08.06.15 at 3:41 pm

Sebastion@2

Yeah, my argument is that it is likely that all four dynamics are playing out in various sectors in various ways. As for rent seeking/extraction, I prefer the term “privilege seeking,” as I think it gets to the heart of the matter in a way which is less confusing to non economists.

Swami 08.06.15 at 3:44 pm

John,

I don’t think the distinction is in any way pedantic or trivial. Your rewritten version is substantially more accurate and less misleading.

TM 08.06.15 at 4:59 pm

5: what are “non-cash payments from the government”?

Regarding the trend in median household incomes, it is worth noting two points:

* The peak was reached around 1999 and household incomes have fallen ever since, not just since the 2008 crisis.

* Median and mean salaries (i.a. worker earnings) have been remarkably flat in the same time period. There was a slight decline after 2007 in median earnings but nothing comparable to the decline in household income. The household income decline clearly reflects a quite dramatic decline in the employment rate. This decline persists despite a low nominal unemployment rate.

CT Readers may be aware that real median earnings have been flat for fully 40 years, at a bit over $40,000 (that is for full-time workers only), with the only noticeable uptick in the 1990s. Mean earnings have increased between 1980 and 2000 but have also been flat after 2000. These data would indicate that inequality isn’t primarily driven by the growth of very high salaries, but rather by capital income. But maybe the Census data do not capture the incomes of the top 0.1%. I am using only the earnings of full-time year-round employees for comparison, see the US Census Bureau’s historical income tables P-43.

L2P 08.06.15 at 5:24 pm

Swami, FWIW I read them both as identical.

Also, looks to me like you’re conflating “the things rich people are doing makes poor people better off” with “the money rich people have makes poor people better off.” There’s certainly arguments that the first statement is true; I’ve never heard anyone argue that rich people existing and being rich, standing alone, makes poor people better off.

Plume 08.06.15 at 5:37 pm

TM,

One thing that furthers the confusion about wage discrepancies in America is that median income figure. In reality, it’s far lower than 40 to 50K for individuals. All too often the figure is given for households, which may include several incomes. Those median household incomes are not averages within the house, but the cumulative totals per household.

The actual median income for individuals is roughly 28K, give or take a couple of thousand per year. It’s really quite abysmal in an economy that produces single year incomes of more than a billion.

Plume 08.06.15 at 5:51 pm

Also, despite age-old American stubbornness to accept this fact, business owners make money by radically underpaying employees. They derive almost their entire income by NOT paying for hours worked. The more unpaid labor time they can wrack up, the more money they can put in their own pockets, or the pockets of their investors. It is patently, blatantly obvious that the math works this way, must work this way, has always worked this way under capitalism.

1. Business owners go into business to make money.

2. Business owners hire only enough workers to fill orders.

3. The more they pay those workers, the less they have for themselves.

4. See #1.

There is a permanent conflict between ownership and labor that can never be resolved under capitalism. The incredibly rare exception being a business owner who doesn’t really care if he or she makes any money. As in, unicorns.

While true democracy will always be in direct conflict with capitalism, simply by nature of its (capitalism’s) authoritarian, hierarchical, autocratic foundation and structure, our consolation-prize version can at least slightly reduce the inevitable structural effects. Slightly. But working against even that is the fact that capitalists own our so-called democracy, our politics, which almost guarantees that any mitigation of its effects will be grossly inadequate, temporary and constantly in danger of being rolled back.

In short, anyone who thinks we can solve the problem of gross inequality and keep capitalism as our economic system is, to put it gently, naive.

Swami 08.06.15 at 5:58 pm

L2P,

To be more clear, rising incomes at the top could be propping up otherwise greater declines in the median via investment, job creation, product quality improvements and such (iow, the 1% are making large returns on these actions which also benefit workers or consumers or smaller investors) . However another way which just being wealthier improves the median is by consuming things.

Just to reiterate for the benefit of casual readers not perusing my first comment, it is also possible for the wealthy to take actions which benefit themselves yet harm the median. For example, closing a domestic factory and replacing it with a lower cost and or higher quality overseas factory (increasing profits to the 1%). This then leads to my second point above. It could be that higher median incomes worldwide (which have increased phenomenally over the relevant period) are also related to the less than stellar median trends domestically.

Plume 08.06.15 at 6:11 pm

Swami,

When the top makes more, by definition the middle and the bottom make less of the total available in wages and wealth. That’s just math. It can’t work any other way.

To assume that everyone can make more assumes some kind of infinite pool of money. It’s finite. Again, by definition.

Historically, America has only had one period where the middle gained ground on the rich. That was, roughly, from 1947-1973. Its gain came at the expense of the top. The reverse is always true as well. The top gains at the expense of the middle and the bottom. The money has to come from somewhere, from some potential recipient, from some donor. It doesn’t, well, you know, grow on trees.

Swami 08.06.15 at 6:16 pm

Another question on the wording of the conclusion and its implications. Again, I will try to be substantive rather than pedantic.

“The people who caused the crisis were mostly born before 1945 because they were of the right age to hold powerful positions in the financial sector in the 1990s. But it was their membership of the 1 per cent that is what matters here.”

Can’t the same logic be applied to the 1% argument as is used to dismiss the age cohort? Just as being the right age is part of what determined that they were in positions of power, so being in positions of power in the financial industry determined that they were in the 1%. On the other hand, lots of people (indeed approximately one person out of every hundred) is in the 1%. So most of this group had nothing to do with the mess. Just the bad apples as they say.

To put it another way. Most of the top 25 were white too. But I wouldn’t argue that “being white is what matters here.” Would you?

TM 08.06.15 at 6:28 pm

Plume 17, I am quoting the Census figures for individual earnings. Do you have a reason to believe that these figures are not reliable? Be careful, the $40k figure is for *full-time year round employees only*. That of course excludes many low-wage earners. The reason for choosing that statistic for longitudinal comparison is that it is unaffected by fluctuations in the share of part-time workers. The fact that it has been flat for 40 years is a pretty strong indictment of US capitalism. This also shows btw that gains in median household income prior to 2000 are almost exclusively due to more women entering the workforce.

JimV 08.06.15 at 7:15 pm

TM @ 15, re non-cash payments from the government, what are they?

My guess is cheese: https://en.wikipedia.org/wiki/Government_cheese

Might also be food-stamps. Of course, both sources have declined from their peaks, so their inclusion would not reverse falling medians, but when you’re debating inequality, austerity, climate-change, evolution, and so on, you go to war with the arguments you have, and also those you would wish to have.

TM 08.06.15 at 7:41 pm

Food stamps have peaked at about 70 billion a year, or about $650 in “uncounted” income per statistical household. The figure has increased significantly since 2000 but it’s still not going to make much of a difference in income statistics. More to the point, even though 45 million Americans receive food stamps, they are unlikely to be in the middle of the income distribution. The median is a useful statistical concept after all.

Cassander also complains about the exclusion of benefits. Employers’ cost of health insurance benefits has increased, that is true, but employees aren’t getting any more or better benefits. It’s just inflation and not real income growth.

TM 08.06.15 at 7:47 pm

Food stamps statistics: http://www.trivisonno.com/food-stamps-charts

SamChevre 08.06.15 at 8:19 pm

Non-cash benefits–the big three are housing benefits (public housing and Section 8 rent assistance), food stamps, and Medicaid.

Plume 08.06.15 at 8:24 pm

TM,

The flatness of wages for the working class is obscene. Basically, no raise since 1973. As for questioning the numbers. Will double check. But last time I did — and that was a few months ago — the individual median was roughly 28K, and the household was roughly 50K. Give or take.

Your caveat of full time, non-seasonal employees may be the difference. That could explain the discrepancy.

Anyway, thanks for the clarification.

Plume 08.06.15 at 8:28 pm

Also, the complaint about added benefits being left out is matched and bested many times over by the end of pensions. Employees have lost guaranteed pensions, which far exceed 401K contributions from employers. And Hobby Lobby opened the door to substantially whittle away at health care bennies as well. One need only cite “religious beliefs” that are supposedly “sincerely held,” with no testing whatsoever, to cancel this or that on the owner’s say so.

The trend is for less and less pay, fewer benefits, more jobs shipped over seas, more jobs automated out of existence, etc. etc. It’s not looking good for the middle class and below.

TM 08.06.15 at 8:39 pm

Sam 26: Non-cash “benefits” is probably what cassander meant (instead of “payments”). Again, these benefits are not likely to have an impact on the median household. If they were counted as part of household income, they would increase the lowest quartile but not the median. They would also increase the mean, so the distance between mean and median would actually go up. Otoh, if employer paid benefits were included, the median would would increase but so would the mean. Employer paid benefits are probably highly correlated with gross pay so including them wouldn’t change the inequality picture.

Swami 08.06.15 at 11:47 pm

Plume writes:

“When the top makes more, by definition the middle and the bottom make less of the total available in wages and wealth. That’s just math. It can’t work any other way. To assume that everyone can make more assumes some kind of infinite pool of money. It’s finite. Again, by definition.”

Can I ask the regulars here to please field this comment? If I answer, Plume may assume it is just some extremist opinion. It may help to hear the answer from the trusted regulars.

If nobody wants to step up, I will gladly take a shot at answering tomorrow.

None 08.07.15 at 12:06 am

IIRC, isn’t Rattner Paul Krugman’s whipping boy ? I imagine there should be something fun from Krugman on this soon.

John Quiggin 08.07.15 at 12:29 am

@30: It’s not a logical necessity, since the rate of growth might have increased. Empirically, it’s even worse than Plume suggests. Growth in mean income has slowed, while the share going to the top 1 per cent has grown rapidly.

And, since you seem to be implying the opposite, it’s pretty clear that

(i) The growth we did see arose largely from the Internet, a public sector creation

(ii) The most highly rewarded section of the 1 per cent, the financial sector, was a massive drag on growth

TM 08.07.15 at 1:39 am

30: Plume’s statement is logically incorrect. It happens to be empirically true, in the current phase of capitalism, but I’m not happy with the sloppy reasoning either.

Re your 1: “It could be that the two trends (downward median and upward superstar incomes) are two unrelated trends.” Yes, it’s logically possible. Even your final suggestion (the middle class would be even worse off without the super-rich) is not logically impossible. But empirically the coincidence between the two trends is so conspicuous that no unbiased observer would find these possibilities plausible. And of course there’s a large body of empirical work, which many regulars here are familiar with, underpinning JQ’s conclusions. I agree that all logical possibilities should be taken into account but we don’t have to go by logic alone.

Swami 08.07.15 at 2:02 am

Anyone else care to weigh in?

Swami 08.07.15 at 2:36 am

TM @22

“The fact that it [earnings] has been flat for 40 years is a pretty strong indictment of US capitalism.”

Not really. Here is why…

First, median income (measured in standard of living purchase parity) was pretty flat since humans learned to walk upright. Pretty much every society has, over the long term, approached the Malthusian attractor point. In economic terms that means living standards of about two or three or maybe in the best of times four dollars per day (such as after population decimating plagues or in brief Golden ages). The attractor point is subsistence level and to envision it, consider the poorest places on the planet today and imagine them without modern medicine and transportation.

Capitalism (wide-scale free markets), along with science, modern institutions, fossil fuels and a few other breakthroughs in technology and mindsets changed all that. Starting a few hundred years ago, not coincidentally immediately after the Wealth of Nations was written, median incomes started to skyrocket, first in Britain, then the US and the “West”, then in any state anywhere adopting their particular mix of the breakthrough combination. Capitalism was not sufficient, but clearly it was be a necessary ingredient in this unprecedented advance in human prosperity. Ten times as many people making on a per capita average ten times as much.

The point is that “flat” isn’t the anomaly, and capitalism is a necessary part of the solution, not the problem.

Second, you make a common mistake on defining the applicable market of capitalism. Capitalism is now global, and median incomes are not flat, they are rising and have done so at an increasingly fast rate (with gains not coincidently concentrated primarily in those adopting more rather than less involvement with markets such as China as opposed to Cuba and N Korea).

So, no, there is no indictment of capitalism (defined as free markets) here. As I mentioned in comment number 1, there is a relationship between the one percent within the wealthy nations, the median incomes within the wealthy nations, and the median incomes worldwide which includes the huge gains over the last generation in the poorer places adopting market based institutions. These three trends are interrelated in various ways, some positive sum and some zero sum.

World prosperity continues to increase, but there is nothing in capitalism which ensures all people will gain at the same rate, or that sub groups won’t lose out (or stop gaining as is the case here).

By the way, I hope it is OK that I am not just agreeing with everyone. Other opinions — even contradictory ones — are appreciated and valued here…yes? If you guys would rather I leave, just say so. I don’t want to spoil everyone’s party.

John Quiggin 08.07.15 at 4:20 am

Swami, it’s OK to disagree, but since you’ve been here you haven’t come up with anything I haven’t seen many times before. So, I can’t be bothered repeating the responses I’ve made to others previously. If you want to find them, read my posts in the archives.

TM 08.07.15 at 12:57 pm

I fail to come up with a sufficiently sarcastic response…

Ok short answer. Wages have been flat for more than a generation while productivity has increased. That means that the benefit of rising productivity has been appropriated by a tiny class of oligarchs while the mass of the people have seen their living standards stagnate at best. You disagree that this is an “indictment” of capitalism. Fine, it’s a judgment. At least you agree that the facts are the facts, which is a start.

Plume 08.07.15 at 1:18 pm

TM,

It most certainly is logically correct. People are confusing overall GDP growth with distribution. On the ground, the overall growth is irrelevant. What matters is how the individual pie is divided per business, and it makes zero difference per business if overall growth has increased. Their own growth is also irrelevant if they adhere to the same kind of percentages of the spoils. That means when they grow, they pay more to the top at the cost of everyone else.

Every business has a finite payroll. If they give the lion’s share to the top, then that money is now totally inaccessible to the rest of the staff. They can’t exceed their total pool, giving a huge amount to the top AND their staff, unless they want to borrow. And that borrowing has to come from somewhere, too, which means someone else has less.

Again, it’s just math.

To believe otherwise is to believe there is no cap on resources, anywhere, ever.

Also, “growth” is a very tricky wicket. Growth of what, exactly? Profits? Gross? Net? And all of that growth must come from somewhere, too. It doesn’t appear out of thin air. If corporation X has an increase in any of those things — gross or net — that means some other business must have less. There is a finite amount of consumer, investment, banking, government dollars to allocate. If Google gets a huge bump one year, for instance, it means other firms (and/or workers) are receiving less. Again, by definition. Less from advertisers, or consumers, or banks, or investors, etc. etc. Or they’ve cut staff. Somewhere, someone, or many somewheres and many someones have moved a portion of their money from A to B, which means A no longer has it.

The American fiction — and it’s highly destructive fiction — is to suppose that growth can exist without any costs. This is physically and mathematically impossible.

Plume 08.07.15 at 1:42 pm

Swami,

BTW, capitalism isn’t just “widespread free markets.” It is the first economic system based upon M-C-M and exchange value, with a predomination of employer/employee relationships. It is the capitalist, purchasing commodities in order to make money, and labor is one of those commodities. He or she then appropriates the surplus value production of the workers as his/her own, and redistributes a tiny share of the total back to the workers who make it all possible. The capitalist makes most of their money via the accumulation of unpaid labor. The more they can squeeze out, the more they can pocket for themselves.

Capitalism rose by violently suppressing self-provisioning and self-providers, by destroying the single producer and farmer, who once made and then sold his or her own goods, locally. That prior model was C-M-C and use value. Capitalism replaced it with its grotesquely immoral system of plunder and redistribution upward.

Also, three billion people live on less than than 2.00 a day. The richest 20% consume 85% of all resources. It’s a myth to claim that “capitalism” has raised living standards. It has destroyed them for the majority.

Fewer than 80 people hold as much wealth as the bottom 3.5 billion, and by next year in America the 1% will control more than half of all wealth. No system with those stats can be called anything but obscene.

TM 08.07.15 at 1:57 pm

Plume, I’m not sure what your point is. Surely you agree that there’s a difference between what is logically possible and what is physically possible? For example, your last statement:

“The American fiction — and it’s highly destructive fiction — is to suppose that growth can exist without any costs. This is physically and mathematically impossible.”

I agree that [economic] growth without [environmental] costs is physically impossible (assuming reasonable definitions of these terms) but mathematically? What does it even mean to say it’s “mathematically impossible”? I have no idea. I just would be very careful with throwing around “it’s just math” as an argument about the real world and I’m saying this as a Mathematician. It is definitely mathematically possible for the whole income pie to grow so fast that the income of the poor increases even if the rich take an increasingly large share of the whole. To say otherwise is just wrong and makes a poor impression.

Bruce Baugh 08.07.15 at 1:59 pm

John, I’m very happy to see this kind of post. I know a bunch of Boomers, including my older brothers, and for every George R.R. Martin-type success story there are a lot of people who haven’t had stable employment in years or decades, who’ve had savings wiped out one way or another, and who are hanging on as best they can. In short, who live lives very much like my friends in later generational brackets.

Plume 08.07.15 at 2:16 pm

TM,

You’re arguing something else.

I’m saying giving more to the top will always be at the cost of the rest of the staff. It is mathematically impossible for it not to be.

For instance. You have a million dollar payroll in 2012. In 2013, due to huge “growth,” you double it. But you still maintain the same percentage of allocation, with the top receiving the lion’s share. Mathematically (and likely contractually) that money is not available to anyone else on the staff. It’s allocated for the top.

Logically and physically, it can’t be in two places at the same time — with the top and the bottom . . . . or, by extension, still in consumer hands, or banks, or investors, etc. etc. while also being in that particular business.

I am not trying to say that the bottom can’t see a doubling in their particular salary, if a business grows enough and the money is allocated that way. I am saying that if the percentage remains the same, or close, or is in some way unequal, then the bottom suffers a loss of potential income because most of it is going to the top.

Again, you can’t go above 100% of something. Unless you borrow. But, as mentioned, that means some other entity has less, and that borrowed money has to be paid back eventually. It always has to work out to 100% of something eventually, not 125%, etc. etc.

Worker A makes 25K prior to expansion. Her boss makes 500K. That is 500K that is not available for worker A or anyone else on staff. If you double the total pool and keep these percentages, the boss makes 1 million and worker A 50K. Yes, she did see a raise. But her raise is far less than it potentially could be because the boss makes a million — and his or her fellow execs likely make close.

As in, what is allocated for the top is off the table for everyone else, whether you double, or triple, or quadruple the size of the payroll.

Plume 08.07.15 at 2:24 pm

In a sense, it “floats.” Increase size on individual business levels or nationally, and it will still always be true that what is paid to the top comes out of the pockets of others. Directly and indirectly. Workers, consumers, banks, investors, the future, government, etc.

It can’t possibly come out of thin air, or be in two places at once. It’s either in their hands — the execs — or in the hands of the rank and file . . . . in in someone else’s pocket.

Pay execs more, you must pay the rest of the staff less. If not less than they currently make, then less than they could be making if your distribution of available funds weren’t unequal.

In short, there is always a cost to the vast majority when it comes to feeding the rich. A billionaire can’t be a billionaire without taking that money from somewhere and many someones. He or she has money because others now don’t. It costs all of us when millionaires and billionaires exist, despite the ingrained American mythos to the contrary.

Plume 08.07.15 at 2:41 pm

TM,

Another angle here.

If the executive staff made 100K each instead of averaging 5 million each, would you admit that there is more money available now for the rest of the staff? Whether or not they actually wind up with the new surplus is another story altogether. But you will admit that there are now more total dollars available for staff, right?

Allocate 20 million for execs. 30 million. 10 million. All of that money is off the table for the rank and file. Raise it, lower it, that alters the potential for wage increases or decreases for everyone else.

This works in reverse, too, of course. Money allocated for the rank and file is not available for the top, unless they change their minds about that allocation. You can’t exceed 100% of something.

Bruce Wilder 08.07.15 at 3:37 pm

Plume v Swami

I almost expect Mr. McMahon to show up in comments to sign one and fire the other.

Not to give Plume too much encouragement, but just as it doesn’t have to be a positive-sum game, it doesn’t have to be a zero-sum game either — it can be worse and frequently is.

The most unequal income distributions are frequently the result of the privileged and powerful making the organization of production less productive and efficient, in order to extract more for themselves, either absolutely or relativity.

Contra Plume I think this political possibility is better attributed to human nature than “capitalism”, per se, but it is also within the scope of human nature to want to do better, and to get too confused to do so.

Roger Gathman 08.07.15 at 5:15 pm

Bruce, human nature, at the present time, in the US economy, does take the form of capitalism instead of, say, feudalism. Although I’d be quick to say that the economy is and will forever be mixed – for instance, the family structure, with its free lunches, is not close to capitalist, in spite of what Gary Becker thinks he has found. The same thing is true with friendships – the economic impact of friendship and alliances within organizations has never, to my knowledge, really been explored. Perhaps you know of some institutionalist text that does so? I’m sympathetic to Plume’s adherence to the Marxist model of exploitation – I do think it is still a fine guide to the structure of capitalism circa now, or the past 50 years, or the past 100. Whereas the idea that the working class is being benefited by the top income earners – vide Swami – by, for instance, the way they can get cheap tat now at Walmart strikes me as risible. Swami is repeating a line that the freakonomics people, and in general freshwater types, love. Logically – since we do love logic – one would think that such abundance of cheap tat would make it better for the wealthy too – one could simply, by state fiat, take away 99 percent of their wealth and they’d still be swimming in world of abundance, such that they could afford the economy size boxes of Cracker Jacks for amazingly low prices at the Walmert nearest their houses at the Hamptons. Logically, I don’t quite see any economic necessity in permitting the wealthy class per se to exist, even by capitalist standards.

TM 08.07.15 at 5:34 pm

Good point Bruce. Negative-sum clearly is a logical possibility and rarely considered.

Swami 08.07.15 at 5:36 pm

TM,

Did you even read the comment?

Median wages worldwide haven’t been anywhere near flat. They have been increasing and doing so at a particularly fast rate of increase. Are you unaware of this? Please answer directly and quit saying we agree on the facts when you keep ignoring this one.

You are simply asserting that “oligarchs appropriated.” The actual situation is:

fact 1) unprecedented expansion of markets to one billion additional workers previously forcibly excluded

Fact 2). Wages increase at a phenomenal rate worldwide, yet stagnate relatively in wealthier nations now facing increased competition from said one billion workers

Fact 3). Capital and “superstars” (entertainers, sports figures, entrepreneurs, financiers and CEOs) capitalize upon the larger markets and new opportunities this generating huge gains while contributing to world growth in GDP and utility.

You are right that the trend of higher incomes at the top, lower rates of increase in the wealthy nations median are related. They obviously are. But the two trends are also related to the other two trends of increasing market size and increasing median worldwide income.

That said, I am sure there have been millions of acts of “appropriation” and exploitation. Poor people have exploited each other, wealthy people have exploited those making less, those in the middle class have taken actions to exploit others and so on. I am anti exploitation of any type. The one clear case though that does NOT involve appropriation and exploitation though is voluntary acts between consenting adults, which is the domain of properly defined markets.

bob mcmanus 08.07.15 at 5:44 pm

I don’t know, I re-read a little Kalecki this morning, and my gut take from him is that as capital share of income increases, profits, investment and national growth decreases proportionally. Of course this is a variant of Marxian economics and the tendency of profits to decline.

Now on the other hand as relative wage/social wage share of nat income increases, investments and profits might go down also, except the likelihood of reproduction/pop increase, innovation, and increased and more refined consumption, providing new opportunities for investment, and thereby growth, is much more likely with an increasing relative wage share of national income rather than increasing relative capital share. Of course, there is a limit to relative wage share.

Lambert over at Angry Bear has been working on some kind of neo-Kaleckian analysis for years.

Layman 08.07.15 at 5:51 pm

“The one clear case though that does NOT involve appropriation and exploitation though is voluntary acts between consenting adults, which is the domain of properly defined markets.”

It’s simply mind-boggling that anyone still believes this nonsense.

Swami 08.07.15 at 5:52 pm

Plume,

Pretty much every thing you have written is economic, logical and empirical garbage. I can’t even begin to start to address your comments, as it is the equivalent of having a discussion on birth control and having to handle questions from someone who suggests we just shoot all the storks. The fact that John can’t even get himself to take on the absurdity of your zero sum fallacy just reinforces the alternative reality of this thread.

Feel free to google median or average worldwide incomes. You will note they are roughly ten times higher than they were pre capitalism (not that this is the only factor). Feel free to then Google the recent trends for people emerging out extreme poverty worldwide. The number is approaching one billion people in the last generation or so.

I wanted to address some other’s comments, but I am coming to the realization that I would be better off talking about astronomy at a flat earthers’ convention.

Consider this my final comment.

William Berry 08.07.15 at 5:55 pm

“Consider this my final comment.”

Is that a threat, or a promise?*

*In any case, doubtless too good to be true.

Bruce Wilder 08.07.15 at 7:10 pm

bob mcmanus @ 49

. . . as capital share of income increases, profits, investment and national growth decreases . . .

The concept of capital as a factor of production has always been problematic. Marx treated C -> M -> C’ or M -> C -> M’, that is the transformative circulation of capitalism, by which the capitalist entrepreneur used finance capital to manipulate the system of production into a system transforming money into commodities into more more money, as a shell game. And, he was sure he could trace the pea, and reveal how the con was run, and how the worker was deprived of value.

Marx also recognized that there was a real increment to productive powers associated with the accumulation of capital, a conception he accepted though he regarded the concentrated ownership of accumulated capital as an outcome of the shell game.

The marginalist analysis of the accumulation of capital is that the Law of Diminishing Returns applies, and the accumulation of capital must, in the limit, depress the returns to capital. Production requires a combination of factors and for labor to realize its productive potential, labor must have access to means of production. The politically powerful can mediate or broker this access to the means of production, and derive income from this essentially predatory or parasitic gatekeeping role. In a feudal system, this is a matter of brigands and their descendants claiming through fiefs, exclusive rights to the productive power of nature, which in modern times had been transformed into private property in real estate.

The classical economists, other than Marx, rather seemed to enjoy the subversive implications of their analysis, with regard to the claims of the wealthy landowning classes, to rents for nature’s bounty. The pejorative connotations of “rentier” trace back to that analysis, I think, and have been renewed from time to time.

Capital investment and consequent capital accumulation, with increments to productive potential, introduced a novel factor of production, a hybrid of commodity and land. Sunk-cost capital investment in dedicated capital equipment, organization and knowledge created a factor of production, which, like land, earned income that was mostly or entirely economic rent, but, given the increment in productive powers associated with that investment, whether the income claimed by capital was earned or unearned, could be controversial. Like Adam Smith’s improving landlords, the capitalist entrepreneur is a hero, and heroes may claim their due, though their glory be founded on essentially the same violence, blood and gore as ordinary mercenaries, brigands and thieves. In reality, William the Conqueror was a ripe bastard at the head of an army of dangerous and violent men building moat & bailey castles as a means of extracting income from an economy of subsistence agriculture at the point of a sword, but a mythology was created in due course of knightly chivalry, in which protection of the weak was their mission. Swami’s perfect circle standard of voluntary market transactions belongs to the same class of mythology as chivalry, and serves a similar political function, in obscuring a problematic reality.

But, I digress.

oldster 08.07.15 at 8:08 pm

“The one clear case though that does NOT involve appropriation and exploitation though is voluntary acts between consenting adults, which is the domain of properly defined markets.”

Oh, god–this is so hilarious.

Thanks for the laughs, swami. Your material was a bit repetitive, but the best jokes were very funny indeed.

Julie 08.07.15 at 9:59 pm

You are all being so very mean to poor Swami who is possibly a millenial?

I am sure he/she is truly sincere – although the tone is very disingenuous and could suggest that this person is operating on the basis of a dysfunctional self-assessment. Maybe Swami only appears to be stupid because he/she doesn’t get out much to meet the real poor people?

And perhaps this person only appears to be too lazy to read some of the past threads that may be enlightening. I think that there are some people who think they are so special and their thoughts are so unique that they should not have to read anything to background their arguments.

Collin Street 08.07.15 at 10:11 pm

> It’s simply mind-boggling that anyone still believes this nonsense.

Genuine mental problems in the autism spectrum.

Julie 08.07.15 at 10:38 pm

Collin, there is nothing wrong with autistic s who are properly socialised and we have brains that can change.

oldster 08.07.15 at 10:48 pm

The problem here is less likely to be ASD (Autism Spectrum Disorder) than ASUD (“Anarchy, State, and Utopia” Disorder).

Julie 08.07.15 at 11:18 pm

Maybe there is a correlation between poorly socialised and high functioning ASD and a preference for AS and U beliefs?

Collin Street 08.07.15 at 11:32 pm

My experience is that basically all market fundamentalists

1. have difficulty with social cues like our Swami here

2. have a rambling badly-structured written style

3. are dogmatic

4. have a short temper and simultaneously pride themselves on their rationality.

At some point I have to start drawing provisional conclusions.

[plus, you know: market fundamentalism is a rules-based mechanism for explaining and predicting human behaviour. On the face of it you’d expect that to be more attractive to some people than others.]

Julie 08.08.15 at 12:50 am

From my own experience when I was young and foolish, and un-diagnosed with ASD, it is not a choice to not see social cues. They really are opaque for some of us.

It was a realisation that I came to some time ago that there actually are people who like and care about society and that these people are not stupid; they actually have abilities that I don’t have, and I understood what my father had told me and I never understood when I was younger, that it didn’t make me a better person because I didn’t need what ‘they’ needed.

I think this realisation – it was a process that I cannot explain – has to come from actual face to face experiences if it doesn’t happen as part of normal development during childhood. The Swami type of person, that I am imagining, has had such a privileged and cocooned upbringing that they never had the experience of meeting victims of coca cola and the other things and stuff capitalism makes and does to make our human lives so much better.

Although, it is possible that talking therapy could produce some insights but as the old joke goes; it only takes one psychologist to change a lightbulb as long as the lightbulb wants to change and why choose to want to change?

It is perhaps only when they themselves experience capitalism in the way the poor do, that we autistics can develop the cognitive capacity to make the realisations that underpin the self-insight process that leads to seeing the others.

And …. in my experience of living in a family full of high functioning ASD people, most of us also have Oppositional Defiance Disorder. But if we choose to overcome – for whatever reasons – our ODD tendencies we can also make some changes in ourselves.

So to conclude this anecdotal information session, maybe Swami will choose to read the arguments that have already been made as to why capitalism sucks.

john c. halasz 08.08.15 at 1:02 am

I would guess that “Swami”, given his handle, is of Indian origin. Cut him some slack, on that basis alone, from your “first world” perspectives. (Though he’s still full of it).

engels 08.08.15 at 1:08 am

the family structure, with its free lunches, is not close to capitalist, in spite of what Gary Becker thinks he has found

“Within the family [the husband] is the bourgeois and the wife represents the proletariat”

Collin Street 08.08.15 at 2:14 am

> I would guess that “Swamiâ€, given his handle, is of Indian origin.

If a market fundamentalist called themselves “comrade” I’d assume pretty strongly that they probably didn’t come from russia. Swami is a word tied closely with indian culture and religious tradition: market fundamentalism is a modernist movement and rejects such things. It’s fairly likely that our swami doesn’t come from a place/time/context where real non-metaphorical swamis are a commonplace thing. Not impossible, but… .

[mind, second generation, or born there and grew up here? absolutely, but then they’re ontologially first-world and don’t get consideration for being “indian”.]

[also, kokopelli is a sex god and it ain’t his flute he’s blowin’. The perils of misappropriation: I’ve got a handle on another forum that’s… not appropriate, had I properly appreciated the source. You live and you learn.]

js. 08.08.15 at 2:15 am

That’s a little condescending, actually. I mean, I’m of Indian origin, and I certainly wouldn’t want any slack cut because of it.

Roger Gathman 08.08.15 at 2:19 am

Even Marx didn’t take that as a universal sociological insight, partly because he had no data. The family, in western europe in the 19th century, was much closer, I’d say, to a guild economy than a purely capitalist enterprise. Marx predicted guild enterprises would disappear – in fact, in the US, the twentieth century saw a boom in guild enterprise, with guild like restrictions encompassing around 30 percent of the labor force according to Kleiner and Krueger, as no doubt you know. But to return to the family, we have more data, and more work, on family economic processes, within late capitalism. Although I am not a complete fan of Viviana Zelizer’s , particularly her last book, the Social Meaning of Money is good at showing the a-capitalist signification of money within families, which remain unpenetrated by the logic of the marketplace. Which is one of the reasons Rattner is talking out his ass – it isn’t as if the kids decide to throw grandma on the scrap heap if she doesn’t get social security.

john c. halasz 08.08.15 at 2:27 am

%65:

No, not really condescending, if you consider the large gap between first and third worlds, (and how odd our complaints must seem in that perspective). Look, I have no idea who this guy is, nor how he is situated, but however wrong-headed his views, he might be looking out on a different world than most of us experience.

js. 08.08.15 at 3:07 am

No, not really condescending

It is, though. I don’t know about the “gap between first and third worlds”—I mean, I don’t know what to make of that statement, exactly—but I do know a little bit about India, or at least the urban middle classes there. They’re… not from Mars, let’s say.

Or, let’s try this another way. I come from a background where being a CP member was normal, almost expected. Needless to say, I often find the shape of political discourse in the US to be a little odd. I come from a “different political world”, you might say (and you wouldn’t be entirely wrong). But it would be frankly insulting if people suggested “cutting me slack” because of this. I mean, just take my, or Swami’s or anyone else’s argument on its own terms. Although, maybe I should be cutting you and other “first-worlders” some slack for lack of knowledge about the world beyond your narrow confines.

js. 08.08.15 at 3:07 am

Oops. First bit in last comment is jch.

Julie 08.08.15 at 4:19 am

Def not condescending from my first world perspective which perhaps might not be the one that you imagine or guess at.

Wanna guess how I fit into the capitalist world? As someone who has sucked at the teat of the taxpayer for most of my life; raised 4 kids with 2 different fathers all on the single parent pension. A welfare queen you could say.

john c. halasz 08.08.15 at 5:18 am

js. @68:

Did you bother to deal with “Swami” in the last thread? Why not? Is it because economics isn’t you’re bailiwick and you’d rather deal with matters on a purely normative level rather than deal with functional issues?

Look, I have no idea who “Swami” is, other than inferential clues from what he’s professed. And I told him he was just asseverating, i.e. repeating his assertions without supporting or modifying them. But rather than just piling on with raillery, I said stop and consider where he might be coming from, because even though he’s full of it,- (and his repeated invocations of Adam Smith and the “Malthusian trap” are not just poor scholarship, but might indicate a pathetic degree of Anglo-philia),- his confabulations are dealing with real issues, (as opposed to the standard right-libertarian trolls here).

You want to take arguments purely in “their own terms”? How very like an academic philosopher. (What’s the market for Kant scholars in India like?) And what’s this imputation about my “narrow confines”? I’m pretty alert to states-of-affairs in the broader world. (I’ll admit that I don’t know a whole lot about India, but then how much do you know about Hungarian history?) Instead you just see fit to indulge in “identity politics”, which is an excellent way to promote obfuscatory self-righteousness, while remaining blind to the various conditions of others.

ccc 08.08.15 at 6:33 am

@Quiggin OP: You convince me that the “generation game” is in most cases overblow. But in the OP you use data on median real household income data but also talk about “life outcomes” which is a broader category. I’m curious what kind of life outcome data would, if it appeared, convince you that there really is a “generation game” type pattern going on. Would for example differences in longevity or medical treatments available be a contender?

Peter T 08.08.15 at 7:02 am

swami is just doing what economists mostly do – deal in idealised fictions rather than empirics. And since economists set the tone, most discussion of economics follows along. As in repeated references to “capitalism”, as if the economies of C19 Europe were the same as those of Europe today. Or to “feudalism”, usually characterised in a way that would be unrecognisable to anyone conversant with the medieval history scholarship of the last 100 years. Or “markets”, not only as an ideal type but as somehow an invisible but real presence in our economic lives…

We would be a lot further forward in making economies actually work if the profession had ditched theology for empirical investigation a century or so back. On the other hand, we would have deprived ourselves of many hours of fascinating argument…

Plume 08.09.15 at 12:41 am

Yet another angle on the very, very silly notion that it costs society nothing for people to get rich. That it apparently is “created” out of thin air, instead of a shifting of actually existing resources from one place to another. That no one loses if someone gains.

The laws of math and physics seem to go out the window when it comes to capitalism, in the minds of all too many.

Imagine a thousand people, each with one car. They all give their cars to a CEO. Now, do they have their car after they’ve done this? No. Of course not. The CEO now has one thousand of them and his benefactors have zero. It’s fairly safe to say most people would get this. Their car can’t be in their own driveway and that CEO’s at the same time.

Money is the same thing as that car. If you take a dollar out of your wallet and send it to a CEO, it is no longer in your wallet. It is in hers. Can’t be in both places at the same time.

As in, zero sum. He gains a dollar. You lose it. He gains that dollar because you lost it. Math. It’s just math.

That CEO accrues millions or billions by subtracting dollars from elsewhere, from others. Obviously. Usually a combination of workers and consumers, but it also includes every transaction down line, distributors, subcontractors, etc. etc. And, yes, one could say that they receive something in exchange for that dollar. But in the capitalist system, in order for anyone to accrue a surplus of dollars — to be “successful” — they must, by definition, receive far more in dollars than it ever costs them to produce said product or service. And, again, this goes for all down-line transactions. There can’t be winners without losers. It is physically, logically and mathematically impossible.

Capitalism is a series of transactions which result in the redistribution of money upward — if the capitalist is “successful” at it. It doesn’t “create wealth,” as conservatives and right-libertarians would have us believe. It shifts it. It’s just addition by way of subtraction. To believe that it “creates” it is to believe in unicorns, magic, alchemy, etc. etc.

Perhaps one big area of confusion is paid labor. That someone is paid for their time seems to confuse many about what they actually earned for that time. The main way execs and business owners accrue their own compensation, or “profit” on top of that, is by radically underpaying workers for the value of their production. If they paid them fairly, there wouldn’t ever be enough money left over for the folks at the top to amass their fortunes. Again, it would be physically, logically and mathematically impossible. That total value would always float upward as the company grew/increased revenues, etc. If revenues doubled in size, for example, and execs didn’t give the rank and file a corresponding increase, they would be taking an even greater share out of the pockets of their workers — the people almost entirely responsible for generating that revenue in the first place.

Again, it’s a deeply ingrained myth in much of the world, but especially in America, that Richy Rich Dude X got rich without costing anyone else a thing. No harm, no foul, supposedly. In reality, he or she got rich by taking from others. The bigger the fortune, the more they had to steal. If they paid fair wages, conducted fair trade, and priced their items fairly (from the start), they could never, ever amass a fortune . . . . at least not one larger than the average Joe or Jane. It. Would. Be. Impossible. At least for anyone trying to do so through business with employees.

Cranky Observer 08.09.15 at 12:56 am

Mathematicians at IBM develop the concept of the relational database. Programmers at IBM create a practical implementation of an RDBMS. IBM business management of the late 1970s/early 1980s takes their sweet, slooooow time bringing that product to market (at least 10 years if memory serves).

Larry Ellison reads the IBM tech journals and other computer science publications. Realizes the RDBMS is a product that could be of great benefit to business. Hires a bunch of mathematicians and programmers away from IBM, and very good ones from other sources. Coordinates them in developing a commercial RDBMS [arguably better designed than IBM’s] and _actually brings it to market_. Said RDBMS is in fact of great benefit to business, science, growth of the Internet and also spurs IBM to get off its lazy blue behind and start selling its own (pretty good) system. Ellison, a lot of people who worked for him, and his initial investors get very rich – almost entirely in stock options.

Was there loss elsewhere in the economy? Yes, the sellers of non-relational databases (including IBM) lost business, first gradually then rapidly. Various other technology areas lost; various others gained. The overall usefulness of a technology improved making possible things such as Internet databases and commerce, improved access to statistical data, etc. Organizations an people willing paid money to get that benefit and some of those providing it raked some off. I’m not sure how that fits Plume’s story.

Val 08.09.15 at 1:26 am

@ 63

OT, but can’t resist pointing out to you that Engels was talking about patriarchy and the relationship of patriarchy and class in the excerpt you linked. The conclusions he came to about that relationship may be somewhat different than those of the feminist writers I’ve cited, but he was certainly talking about patriarchy and its influence. He even uses the words “patriarchal family”.

From our previous conversation, it seems that patriarchy is a concept you are very resistant to, unlike your namesake. Seems a bit odd.

Plume 08.09.15 at 4:11 am

Cranky,

The “loss” comes in here:

Ellison makes thousands of times more than the workers he employs. He makes thousands of times more than they do because he appropriates the surplus value they create for himself. His gain. Their loss. He couldn’t make his billions if he didn’t do that. He couldn’t make his billions if he didn’t steal from his workers, taking what they produce as if he had produced it, keeping a radically higher share of the total than his own efforts could possibly warrant, giving back a fraction of a fraction of what those workers truly earned via their labor.

He gains because they lose. He can’t gain if they don’t lose. He can’t possibly make billions if he pays those workers a fair wage for their labor, for what they’ve generated, for what they’ve created and produced.

And none of the above includes the other pieces of this puzzle of mass theft, like shafting smaller businesses down the line, overcharging consumers, governments, trading partners, etc. etc. And, when you’re talking about an Ellison in particular, buying up companies, gutting them, firing tens of thousands of workers and then selling the husk for even more profits.

For starters.

Nathan Tyree 08.09.15 at 5:49 am

Thank you for this. I have always viewed this obsession with “generations” as something akin to astrology or numerology. It baffles me that otherwise reasonable people think that the year I was born is a greater indicator of success than race or class. Just strange.

js. 08.12.15 at 1:57 am

Oh, hey! I forgot to respond to jch several days ago! Anyway, it was fun being accused of being “very like an academic philosopher” and of “indulg[ing] in ‘identity politics'” in the very same paragraph—that’s never happened before! Thanks, jch!

john c. halasz 08.12.15 at 2:13 am

You’re welcome, js. But I’m always just as mean as I have to be, (and hopefully no more). Or have you never worked those jobs?

js. 08.12.15 at 2:21 am

What jobs? What _are_ you talking about? Oh wait, do you mean Kant jobs in India? I haven’t lived in India since I was an early teen, of course I haven’t “worked those jobs”. I do have some sense of what the relevant academic landscape there is like, I guess.

john c. halasz 08.12.15 at 2:46 am

@81:

Umm… I’ve never been a straw boss. There have been some straw bosses I’ve liked, many more I didn’t. But I’ve had to deal with the circulating resentments of the rest of the crew. And I’ve always preferred not to work too hard, so as to have enough “leisure” to pursue other endeavors. And IANAA. Capiche?

js. 08.12.15 at 3:22 am

Man, I have no fucking idea what you’re talking about. It’s fine though.

Comments on this entry are closed.