by John Q on April 17, 2013

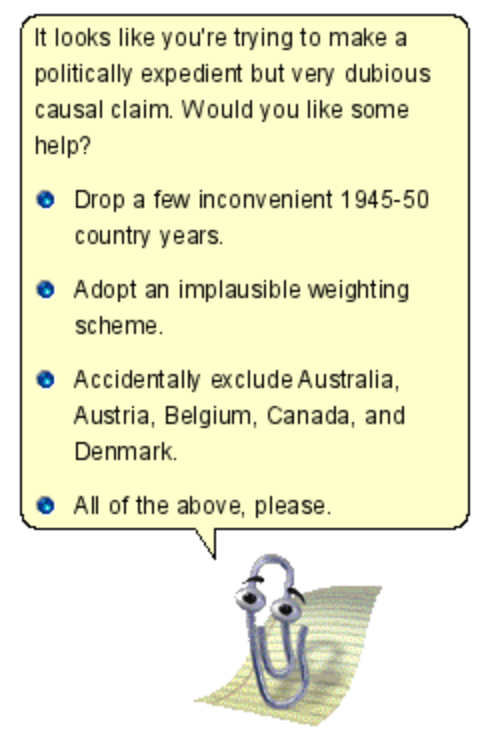

Over at the National Interest, I have a piece arguing that Bitcoin is a more perfect example of a bubble, and therefore a more perfect refutation of the Efficient Markets Hypothesis, than anything seen previously. Key quote

It beats the classic historical example, produced during the 18th century South Sea Bubble of “a company for carrying out an undertaking of great advantage, but nobody to know what it is.” After all, the promoter of this enterprise might, in principle, have had a genuine secret plan. Bitcoin also outmatches Ponzi schemes, which rely on the claim that the issuer is undertaking some kind of financial arbitrage (the original Ponzi scheme was supposed to involve postal orders). The closest parallel is the fictitious dotcom company imagined in Garry Trudeau’s Doonesbury, whose only product was its own stock.

by Eric on April 17, 2013

Today Jim Rickards (author of Currency Wars) says,

Last week I had x ounces of #Gold. Today I have x ounces. So value is unchanged. Constant at x ounces. Dollar is volatile though. #ThinkOz

I know it’s a failing in me, but it is hard not to ponder whether this is charlatanism or delusion. As John Maynard Keynes says in the first sentence of his Tract on Monetary Reform, “Money is only important for what it will procure.” With the stubborn volatility of the dollar, Rickards’s ounces procure rather less than they recently did.

The exhortation #ThinkOz is of course wonderful. I think now of hashtags past…

Last week I had x bulbs of #Tulips. Today I have x bulbs. So value is unchanged. Constant at x bulbs. Florin is volatile though. #ThinkBulbs

Money is a medium of exchange and a store of value, they say.