by John Q on September 19, 2017

I’m doing some work on privatisation and wanted to look at recent UK experience with the Private Finance Initiative. So, I Googled for PFI in the last year (as Google personalizes searches, your mileage may vary). The result is a surprising degree of unanimity. Across the political spectrum, there is agreement that

* PFI is a disaster, enriching private firms at the expense of the public

* The other side is (mostly) to blame

[click to continue…]

by John Q on September 2, 2017

I’ve just given a couple of talks focusing on inequality, one for the Global Change Institute at UQ, following a presentation by Wayne Swan and the second at a conference organized by the TJ Ryan Foundation (including great talks by Peter Saunders, Sally McManus, and others), where I was responding to a paper by Jim Stanford from the Centre for Future Work. Because I was speaking second in both cases, I didn’t prepare a paper or slides, but tailored my talk to complement the one before. That can be a high risk strategy, but in this case, I think it worked very well.

It led me to a new, and I hope improved, statement of the case against ‘trickle down’ theory. As always, the most important part of a refutation is a clear statement of the theory you propose to refute, so that it can be shown where it falls down. After the talks I wrote this up, and it’s over the fold. Comments and constructive criticism much appreciated.

[click to continue…]

by Henry Farrell on August 31, 2017

Over the last couple of months, I’ve been involved in an on-and-off floating argument over Nancy MacLean’s book on James Buchanan and public choice, Democracy in Chains. This essay, with Steve Teles, lays out the problems we see with the book. The book makes very big claims e.g. that Buchanan provided the political strategies that made Pinochet’s Chile what it was, and galvanized an American right that had been in disarray before his decisive intervention. But the evidence that MacLean provides for these claims is problematic – key documents simply don’t say what MacLean thinks they do. MacLean describes Buchanan as an inventive creator of dastardly political ploys, using terms such as ‘evil genius’ and ‘wicked genius,’ but economists, no more than political scientists, make for good competent political strategists – the median is closer to Professor Pippy P. Poopypants than Svengali. [click to continue…]

by Chris Bertram on July 13, 2017

I got into a bit of a twitter fight with the always interesting Branko Milanovic yesterday. It was a second-hand fight, because he’d already been involved in one with Kate Raworth and had blogged about that. What was interesting to me was how Milanovic believed some things to be not only true, but obviously true, which I thought not just false but obviously false.

Milanovic’s claim is that [limitless economic growth is both necessary and desirable in today’s societies](http://glineq.blogspot.co.uk/2017/07/inevitability-of-need-for-economic.html). In fact, he puts the claim in the negative:

> De-emphasizing growth is not desirable, and perhaps more importantly, is utterly unrealizable in societies like our modern societies.

He may be right or wrong about that. If such growth implies increased consumption of resources, then that’s a pretty bleak prospect for anyone who believes in ecological limits, worries about heat death from climate change and the like.

Still, more interesting to me was his reasoning:

> the really important counter-argument to Kate is that her proposal fails to acknowledge the nature of today’s capitalist economies. They are built on two “fundaments”: (a) at the individual level, greed and the insatiable desire for more, and (b) on the collective level, competition as a means to achieve more. These are not necessarily most attractive ethical characteristics for either individuals or collectives but they are indispensable for capitalism to function—they provide the engine that pushes it ever further. … This extreme commodification is obviously linked with insatiability of our needs and by our desire to climb up in hierarchical rankings. Since today’s uber-capitalism accepts only one ranking criterion, money (and since all other possible ranking criteria can be, through commodification, converted into the money-metric), the desire for higher societal rank is almost entirely identified with the desire for higher income. And if everybody wants to have higher income, how can we then argue they our society should cease to place a premium on economic growth …. ?

[click to continue…]

I just finished Richard Rothstein’s brilliant — and far from uplifting — book The Color of Law . It’s been getting a lot of favorable press, and rightly so.

. It’s been getting a lot of favorable press, and rightly so.

The book accepts (for the sake of argument, maybe — Rothstein is always parsimonious in his arguments) the principle that Chief Justice Roberts puts forward when he says that if residential segregation ‘is a product not of state action but of private choices, it does not have constitutional implications’. It is devoted to showing that, contrary to the prevailing myth that residential segregation (between whites and African Americans) is a product of a private choices it is, in fact, a product of government policies, all the way from the Federal level to the most local level, and this is true in the North as well as the South. Housing segregation in the US is de jure, not de facto. And… it shows just that. He makes his case in careful, meticulous detail, but in unfussy and inviting prose, packed with illuminating stories that illustrate the central claims.

Here are some of the basic mechanisms through which government in some cases reinforced and in other created housing segregation:

[click to continue…]

To misquote Benjamin Franklin and others, the only certainties in economic life are debt and taxes. Among the themes of political struggle, fights over debt (demands from creditors to be paid in the terms they expect, and from debtors to be relieved from unfair burdens) and taxes (who should pay them and how should the resulting revenue be spent) have always been central.

I mentioned in a comment recently, that Pro-debtor politics is always in competition with social democracy, and a couple of people asked for more explanation.

[click to continue…]

by John Q on February 8, 2017

That’s the title of my latest piece in The Guardian. There are two key points

First, in terms of effective tax rates and tax paid, any means-tested Guaranteed Minimum Income can be replicated by a non-tested Universal Basic Income, and vice versa

Second, for a number of reasons, it would be better to begin by expanding access to an adequate Basic income (in Australia, the Age Pension is an obvious benchmark) rather than starting with a small universal payment and then increasing it to a level sufficient to live on.

by John Holbo on January 14, 2017

Henry’s post was interesting. It reminded me of an anecdote passed along by an acquaintance, who shall go nameless.

The individual in question is involved in publication of limited run, high quality art books. You can’t do that if you can’t make significant profit, per unit. (‘Volume volume volume!’ doesn’t hack it if you lack volume.) Medium-length story short: [click to continue…]

by Harry on December 7, 2016

In the light of the discussions of charter schools in the poss below, and given that I attended a graduate seminar of education policy students last night at which none of the students had read it, it seems worth re-drawing your attention to Greg Duncan and Richard Murnane’s edited volume Whither Opportunity?: Rising Inequality, Schools, and Children’s Life Chances . Its already 5 years old, but it is really a brilliant achievement, drawing together numerous experts (if we’re allowed to listen to experts any more) with the task of summarizing everything we know about the relationship between economic inequality and educational disadvantage in the US. The take home is fairly simple: there’s a very strong relationship between economic inequality and educational disadvantage and after reading the whole book you might still believe (as I do) that it is possible to improve educational outcomes for poor children through improved schooling but you cannot believe that we could get large changes in outcomes without corresponding changes to the environments poor children grow up in — which would require massive reductions in both inequality and poverty.

. Its already 5 years old, but it is really a brilliant achievement, drawing together numerous experts (if we’re allowed to listen to experts any more) with the task of summarizing everything we know about the relationship between economic inequality and educational disadvantage in the US. The take home is fairly simple: there’s a very strong relationship between economic inequality and educational disadvantage and after reading the whole book you might still believe (as I do) that it is possible to improve educational outcomes for poor children through improved schooling but you cannot believe that we could get large changes in outcomes without corresponding changes to the environments poor children grow up in — which would require massive reductions in both inequality and poverty.

I think its fair to say that the headline study was Sean Reardon’s finding that the achievement gap (measured by standardized tests) between rich and poor students has increased during the same 50 years during which the black-white achievement gap has decreased, as shown in the following graph:

Other findings include Meredith Phillips’ finding that between birth and age six, wealthier children will have spent as many as 1,300 more hours than poor children on child enrichment activities such as music lessons, travel, and summer camp, and the contribution by Waldfogel and Magnusson showing that the gap in ‘enrichment spending’ between rich and poor has expanded massively in the past 40 years — and that affluent families spend more than $8000 a year per child on enrichment activities. A child from a poor family is two to four times as likely as a child from an affluent family to have classmates with low skills and behavior problems – attributes which have a negative effect on the learning of their fellow students, and the rich=poor achievement gap in k-12 is accompanied by a growing income-based gap in college completion.

One of the studies shows that local job losses can lower the test scores of students with low socioeconomic status, whether or not the students’ parents have suffered the job losses; another that and students learn less math if they attend schools with high student turnover during the school year (one count against school choice, but also against allowing landlords to evict tenants with children mid-year).

Of course, to most readers none of these finding will be shocking (though, the Reardon finding is quite noteworthy). But they are worth bearing in mind. I am startled by local school officials for example, who say that citing poverty as a reason for low achievement is an ‘excuse’, and also by academics in education I come across who are reluctant to admit that poverty has seriously detrimental effects on the poor and the ability of poor children to learn (if poverty doesn’t have bad effects on those who are subject to it, elminating it might still be nice but doesn’t seem morally as urgent as it, in fact, is). As I say, I’m only mentioning Whither Opportunity again now after meeting a whole group of grad students who are concerned with educational inequality and didn’t know of it, and being prompted by the discussions of charter schools. Also I’d recommend going to Leo Casey’s comment on one of the threads which gathers together some other useful links.

by John Q on November 19, 2016

The one policy issue that was an unambiguous loser for Clinton was trade[^1]. Her grudging move to oppose the Trans-Pacific Partnership, choice of Tim Kaine as running mate and some unhelpful remarks from Bill Clinton meant that Trump had all the running. How should we think about trade policy after Trump? My starting point will be the assumption that, in a world where Trump can be President of the US, there’s no point in being overly constrained by calculations of political realism.

A few points and some suggestions

* So-called “trade” deals like the TPP were actually devices to enhance corporate power (and, in the case of the TPP, to isolate China), and deserved to be defeated regardless of views on trade

* No matter what policy is adopted, manufacturing jobs aren’t coming back, any more than farm policy can restore an agrarian society. The manufacturing share of total employment has peaked nearly everywhere in the world, notably including Mexico. As is often the case, Chinese data is too opaque to get a clear picture, but there’s plenty of evidence of contraction about

* The idea of manufacturing jobs as “good” jobs is historically specific particularly to the US, and reflects the fact that the dominance of manufacturing coincided with the New Deal and the unionisation of the labour force. It’s unions, not manufacturing that we need to bring back.

* The big problem facing workers, in the US and elsewhere, isn’t competition from immigrants, or from imported goods. It’s the fact that capital is freely mobile and unfettered by any social obligation. So, a profitable plant can be closed down if its owners get a better off elsewhere. Alternatively, the threat of a move can be used to bargain down wages.

So, instead of thinking about tariffs and trade agreements, the big question is: what can be done to change trade and capital flows in ways that yield more good jobs?

Some suggestions over the page

[click to continue…]

by John Q on September 23, 2016

I have a couple of pieces in The Guardian. The first, which came out a few days ago, points out the consistent failure of market competition and for-profit firms to deliver human services effectively and equitably. The second gives the mainstream economic analysis of the problem, in terms of market failure and the mixed economy, developed 40 to 50 years ago, and ignored by the policy class of today, which takes the assumptions of market liberalism (aka neoliberalism) for granted. My summary:

The problem is that the political class, along with much of the economics profession, have done worse than the Bourbons, of whom Talleyrand observed “they have learned nothing, and forgotten nothing”. … Our leaders, and the economists who advise them, have not only shown themselves incapable of learning from experience, they have forgotten much that we once knew.

by Chris Bertram on August 7, 2016

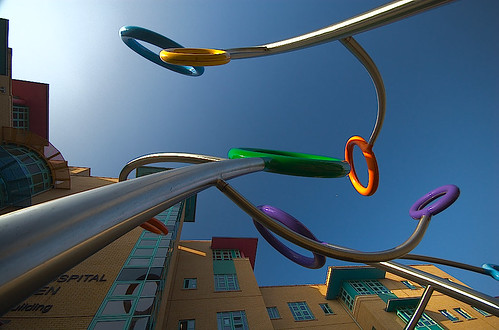

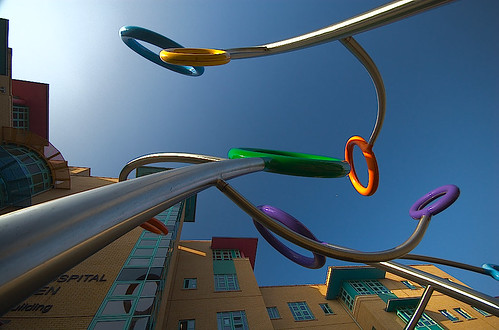

This week’s picture is quite an old one, of the sculpture outside the then-new Bristol Children’s Hospital which is directly adjacent to the Bristol Royal Infirmary, where I spent a good past of the last week following an acute gallstone attack (with associated pancreatitis) last weekend. On the Thursday I had my gall bladder removed (which turned out to be slightly more complicated than anticipated) and by Friday I was home. I’m now resting and recuperating, but basically feeling fine. Some reflections on the experience below the fold.

[click to continue…]

by John Q on August 5, 2016

In a recent post, I remarked on the fact that hardly any self-described climate sceptics had revised their views in response to the recent years of record-breaking global temperatures. Defending his fellow “sceptics”, commenter Cassander wrote

When’s the last time you changed your mind as a result of the evidence? It’s not something people do very often.

I’m tempted by the one-word response “Derp“. But the dangers of holding to a position regardless of the evidence are particularly severe for academics approaching emeritus age[1]. So, I gave the question a bit of thought.

Here are three issues on which I’ve changed my mind over different periods

* Central planning

* War and the use of violence in politics

* The best response to climate change

[click to continue…]

by Henry Farrell on June 17, 2016

Brad DeLong:

Time to fly my Neoliberal Freak Flag again! I see this very differently than … Dani Rodrik … The problem is not that Europe has too little democracy. The problem is that it has the wrong kind. Issues of fiscal stance are technocratic issues of economic governance. … Harry Dexter White and John Maynard Keynes were good democrats. Neither would say that Europe’s economic problems now are the result of a deficiency of democracy. They would say that it is the fault of their IMF–that their IMF should have blown the whistle, declared a fundamental disequilibrium, and required one of:

- the shrinkage of the eurozone and the depreciation of the peso and the drachma back in 2010

- a wipeout of Greek and Spanish external debts, and a fiscal transfer program from the German government to Greece and Spain and to German banks if German authorities wished to avoid such a shrinking of the eurozone.

We did not have such an IMF back in 2010. But that we did not have such an IMF is not the result of a deficiency of democracy in Europe. Or so I think: I could be wrong here.

[click to continue…]

by John Q on April 28, 2016

I’m currently working on a section of my Economics in Two Lessons book dealing with minimum wages in the context of predistribution policies, so I thought I would compare Australia with the US, where the idea of a $15/hour minimum wage is currently a hot topic. In Australia there are two kinds of minimum wage. The PPP exchange rate is estimated at $A$1.30 = $US, which is fairly close to the market exchange rate at present, so I’ll give both $A and estimated $US equivalents

The standard minimum wage for workers aged 21 or over is $A17.29 hour ($US13.30) applying to employees under standard award conditions. These include four weeks annual leave, sick leave, employer contributions to pension plans and so on.

More comparable to the situation of US minimum wage workers are “casual” workers, employed on an hourly basis. Casual workers get a loading of at least 25 per cent, bringing the wage up to at least $A21.60 an hour ($US16.60), to compensate for the absence of leave entitlements. In addition, they have entitlements including:

* “Penalty” rates for weekend and night work (usually a 50 per cent loading, 100 per cent on Sundays)

* For workers employed on a regular basis, protection against unfair dismissal.

The policy question is: what impact have these high minimum wages had on employment and unemployment. That’s too big a question to answer comprehensively, but we can look at the obvious data points: the official unemployment rates (5.7 for Oz, 5.5 per cent US) and the 15-64 employment population ratios (72 per cent for Oz, 67 per cent US). So, it certainly doesn’t look as if the Australian labor market has been crippled by minimum wages.

Note: I’ll respond in advance to the widespread misconception that Australia is a special case due to mineral resources. Mining accounts for about 2 per cent of employment in Australia, and (because most mines are owned by multinationals) its contribution to Australian national income is also so, probably around 5 per cent.

* Workers aged 18 get about 70 per cent of the adult minimum, equivalent to around $US11.50 for casuals. But the great majority of US minimum wage workers (about 80 per cent) are 20+.