The Times tells the story of the failed efforts of one Brooksley E. Born, the chair of the Commodities Futures Trading Association in 1997, to attempt to impose greater regulation on derivatives. “She called for greater disclosure of trades and reserves to cushion against losses.” She was fiercely opposed in this by Alan Greenspan and Robert Rubin. [ed:spelling corrected]

[click to continue…]

From the monthly archives:

October 2008

Man, if I were Al Franken, I’d put this up as a commercial straight with no commentary. (Okay, maybe cut down to 1:00 or :30.) (via Ezra).

Like Kevin Drum, I have been sorely tempted to take a poke at the poor Cornerites in their misery – especially Andy McCarthy – but Hilzoy got there first. You can follow her links. it’s all-Ayers, all-the-time, if you’ve been missing the show. Here’s my analytic contribution on top of the straight mockery: this lot have been reduced to arguing that the problem with Obama is that he doesn’t believe the stuff he’s saying, won’t do anything like the things he’s proposing. Or, in the 10% less crazy Frum version, he’s just got to be an incredibly corrupt Chicago pol. Because he’s from Chicago.

This is funny, first, because it converts Obama’s rather pedestrian characteristic of not seeming to be something radically different than what he seems to be into a maddening sort of rope-a-dope achievement. (How does he do it? That ‘appearing to be the sort of person that he probably is’ thing.) Lowry glowers: “he’s a kind of genius at appearing plausible. If the Nobel committee had a prize for appearing plausible, he’d win it every time.” But Lowry isn’t talking about the power of making implausible ideas sound plausible. He’s talking about the power of making it seem plausible that you believe basically plausible things. [click to continue…]

My wife commented the other day that Sarah Palin has the rare talent of being able to make complete gibberish sound like it means something (a combination of that odd wink, and the modulation of her voice). As usual, my national chauvinism got the better of me: we, the British, have the finest exemplars of that skill, and Palin seems like an amateur to me. Two words: Idle; Unwin.

When my 11-year old tires of the young adult novels she is forced to read (is it really necessary to give pre-teens a diet of child-abuse, divorce, gore, death, and suicide?) she skips to Alan Coren’s Arthur books, long out of print, but marvelously funny. Coren’s been gone for nearly a year, now, and here’s rather sad but loving tribute. Hearing Sandi Toksvig talk about him made me look around for old obits; and I found this lovely account of the funeral by Simon Hoggart.

That bit was hard to miss, but I hadn’t noticed the refusal of the handshake. Ouch. [UPDATE: See some links in comments about how this wasn’t as bad as it might seem. I have looked at these and still think it would have been less awkward and more polite to shake hands there.]

That bit was hard to miss, but I hadn’t noticed the refusal of the handshake. Ouch. [UPDATE: See some links in comments about how this wasn’t as bad as it might seem. I have looked at these and still think it would have been less awkward and more polite to shake hands there.]

With the financial meltdown accelerating in the wake of the US bailout, and the recognition that many more failing banks will have to be nationalized, the British government is moving to get ahead of the game by offering equity injections across the board. But already this seems inadequate. Now that the taboo on nationalization has been broken, wouldn’t it make better sense to nationalize the whole sector? With full control, governments could then ensure the resumption of interbank lending at least among their own banks. This would provide a feasible basis for co-operative moves to re-establish international markets.

For this week at least, such an idea is beyond the range of political acceptability. But it’s striking to look back a month and realise that in that period the US government has become the main mortgage lender, the guarantor of the short term money market, the effective owner of the world’s largest insurance company, the potential future owner of much of the banking sector and now the purchaser of last resort for commercial paper. Since the reluctance of banks to buy commercial paper must reflect a significant probability of default, it seems inevitable that some of this commercial paper will end up being converted into claims on the assets of defaulting issuers, extending the scope of nationalisation beyond the finance sector and into business in general.

This kind of instalment-plan nationalisation seems to offer the worst of all worlds. At some point, a more systematic approach will have to be adopted, and given the rate at which markets are plummeting, the sooner that point comes the better. This isn’t the return of socialism, but it certainly looks like the end of the kind of financial capitalism that has prevailed for the last few decades.

Two current debates about generations and what they mean. First, Siva Vaidhyanathan’s “recent article”:http://chronicle.com/free/v55/i04/04b00701.htm in the _Chronicle of Higher Education_, expressing skepticism about the concept of “Digital Natives”:https://crookedtimber.org/2008/09/22/at-berkman/.

Gomez writes. “For this generation — which Googles rather than going to the library — print seems expensive, a bore, and a waste of time.” When I read that, I shuddered. I shook my head. I rolled my eyes. And I sighed. I have been hearing some version of the “kids today” or “this generation believes” argument for more than a dozen years of studying and teaching about digital culture and technology. … Every class has a handful of people with amazing skills and a large number who can’t deal with computers at all. A few lack mobile phones. … almost none know how to program or even code text with Hypertext Markup Language (HTML). Only a handful come to college with a sense of how the Internet fundamentally differs from the other major media platforms in daily life. College students in America are not as “digital” as we might wish to pretend. And even at elite universities, many are not rich enough. All this mystical talk about a generational shift and all the claims that kids won’t read books are just not true.

Second, Matt Yglesias on whether it’s important that the “kids love Obama”:http://yglesias.thinkprogress.org/archives/2008/10/youth_decay_2.php.

I used to sometimes think that the relatively left-wing views of the under-30 generation were basically just a reflection of the fact that the under-30 cohort contains many fewer non-hispanic whites than does the over-30 cohort. This new report from Amanda Logan and David Madlan makes it clear that’s not right — young whites have substantially more progressive views on a whole range of key issues than do older whites … if you hunt down a copy of the current issue of The Atlantic you should find … a piece by yours truly observing that the present day conservative coalition seems to mostly be stuck with the shrinking slices of the demographic pie. This data shows us one of the major driving factors behind that.

When I suggested a couple of weeks ago that the intellectual hegemony of free market capitalism was under threat, Dan Drezner expressed “polite skepticism”:http://danieldrezner.com/blog/?p=3943.

Is this the beginning of a norm shift in the global economy? It’s tempting to say yes, but I have my doubts. The last time the United States intervened on this scale in its own financial sector was the S&L bailout — and despite that intervention, financial globalization took off. The last time we’ve seen coordinated global interventions like this was the Asian financial crisis of a decade ago — and that intervention reinforced rather than retarded the privilege of private actors in the marketplace. In other words, massive interventions can take place without undercutting the ideological consensus that private actors should control the commanding heights of the economy.

I’m sure there’s nothing to this so-called ‘financial crisis’ that wasn’t explained adequately in that classic Sutherland instructional video, “The Wise Use Of Credit”. If not, then in that companion volume, “What Makes Us Tick”.

We have a friend who travels on business to India a lot. He was discussing how maybe next week isn’t the best week to be away from home because if the whole system melts down he’ll get stuck in Bangladesh, with the airlines unable to buy gas for the planes because money has seized up globally. Getting back to Singapore would be like a cross between Burmese Days and Planes, Trains and Automobiles. Not that he really thinks that. It’s just that everyone is thinking that. I mean: it almost definitely won’t happen.

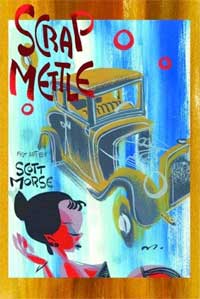

I’ll just talk nonsense for a while. Because: what do I know? I praised Scott Morse’s art a couple weeks ago. Since then I bought a new collection of his stuff, Scrap Mettle

I’ll just talk nonsense for a while. Because: what do I know? I praised Scott Morse’s art a couple weeks ago. Since then I bought a new collection of his stuff, Scrap Mettle [amazon]. You can check out this preview from his upcoming Tiger! Tiger! Tiger! . (If you missed my first post and don’t know who Scott Morse is, you can read his wikipedia entry, or check out this site. I linked to his blog above. He’s done animation stuff and other stuff.) [click to continue…]

We’ve all been strictly enjoined to avoid schadenfreude in the current crisis, and indeed few are likely to escape unscathed. Still I’m struck by a couple of examples of historical irony

* Ten years ago, I was debating representatives of the Dutch bank ABN-AMRO, who were pushing for the privatisation of Australian Capital Territory Electricity and Water (ACTEW). A couple of days ago, the Dutch operations of ABN-AMRO were nationalised

* British Bank Northern Rock was nationalised following a run by customers seeking to withdraw their money. Now, seen as safer than its competitors, it is being forced to limit deposits.

Although I am not commenting on the current crisis, I think it would be irresponsible of me not to point out that I not only saw it coming five years ago, I even suggested a number of potential solutions which were similar in shape to the one actually chosen, but decidedly more innovative. If any readers are emailing their congressmen etc, you can quote me if you like. I promise that I am not trying to talk up a massive speculative book of Beanie Babies.

Though it may have seemed impossibly far off in our hazy youth, these days we fondly look back at the turn of the 21st century and think that was when the world was new and fresh and everything seemed possible. Or searchable, anyway. For one month only, here is Google’s index, c. 2001. It shows that we were present individually though not collectively. Besides nostalgia for this distant past, consider the results of searches such as “housing bubble” or “subprime mortgage lending” or “counterparty risk.”

The Spencer Foundation has just announced the second of its major strategic initiatives: on civic learning and civic action. Here’s the announcement, and here are the application guidelines. Please direct queries to the program administrator (whose contact details are at the bottom of the guidelines page).

And, if you missed it, the first strategic initiative is on Philosophy in Educational Policy and Practice; I am happy to entertain queries on that one.

While you are at their fantastic new website, check out the page devoted to papers resulting from Foundation grants: two interesting papers, one by Eric Hanushek on policy analysis, the other by Helen Ladd on accountability.

Ingrid’s post below (plus a couple of other events) prompted me to look for G.A. Cohen’s new book: Rescuing Justice and Equality (UK

) is apparently already out in the US despite being published on November 1st. I bought several copies (so my students can read it with me), and hereby promise that I’ll have some sort of review here in January (January, because, unlike Richard Arneson, I need time to review books that haven’t officially been published yet).